Auto / Industrial Semiconductors: the bad & the ugly #2

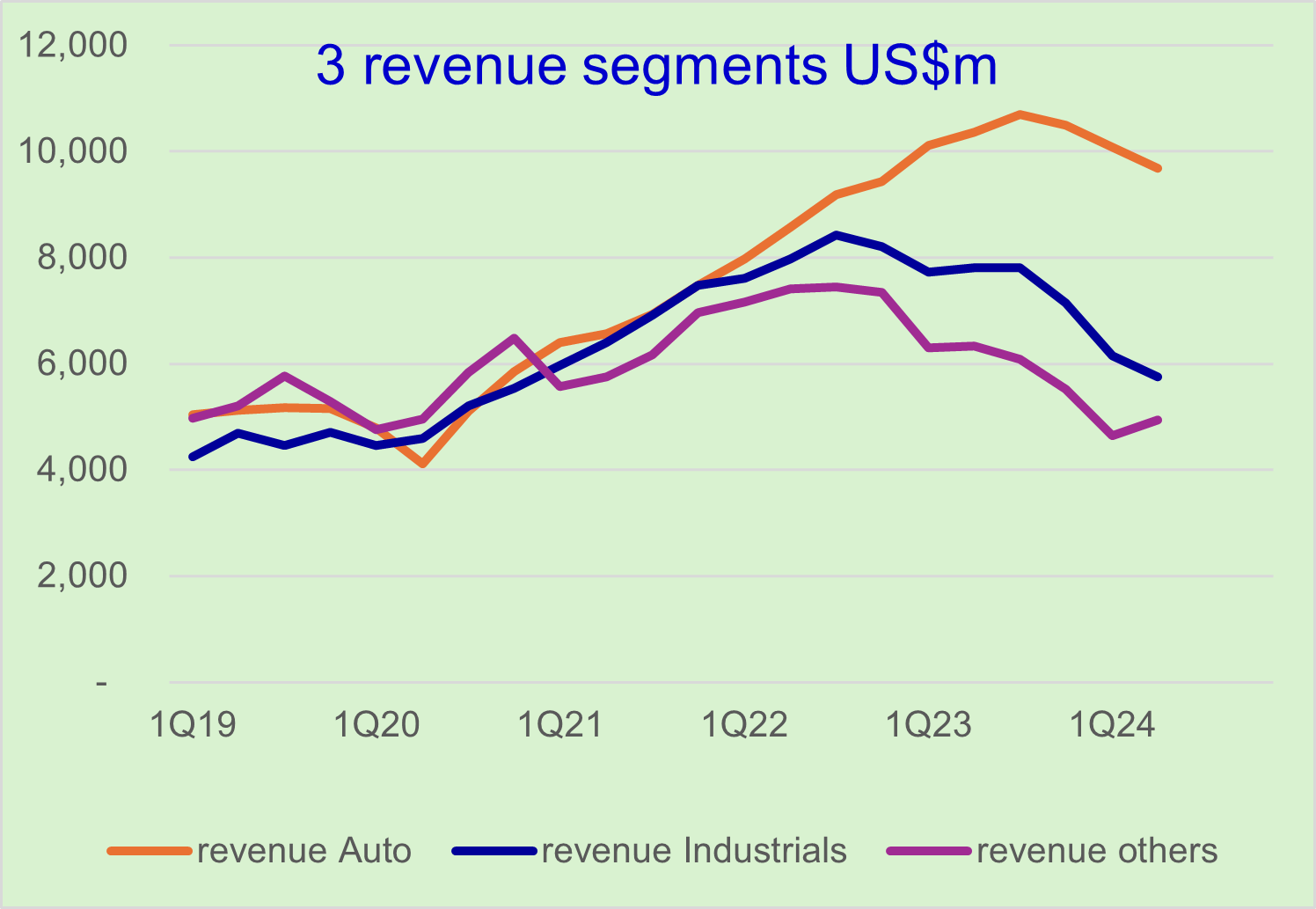

Sum of revenues in US$ m: Analog Devices, Infineon, Microchip, NXP, On Semi, Renesas, ST Micro, Texas Instruments. 2Q means Calendar 2Q ie the April-June quarter.

The late reporters Infineon, Microchip, ON, confirm what the early reporters said. Auto getting weaker. Industrials in EU, Japan, US remains weak. Clients’ inventory digestion still ongoing.

Managements see the perennial “green shoot” or “recovery” on the horizon, but delayed. The long-term positives GaN, SiC, EV, car automation, etc etc. haven’t changed. Yes sure, there is cyclicality along structural trends. We want to know where is the bottom of the cycle.

Firms are not revising down much (largest cut is STM). Firms are not missing guidance in 1Q-2Q24. So there is no “shock”, but persistent weakness.

Looking at 3Q24 guidance, the chart above could suggest that revenues have hit bottom?

Or is it a seasonal effect due to year-end Consumer, Telecom & Infrastructure budgets being spent? Most firms mention sequential growth in 2H24 HoH.

But firms also mention that Auto is getting weaker and Industrials is not improving. That’s ~75% of revenues.

Consensus has revised down 2024-25-26 net income by -3% for each year. That’s small.

Consensus forecasts revenues for the group to decline -14% in 2024 and up +12% in 2025 with a point of max contraction in 2Q24 – really? Consensus forecasts Net Income to decline by -33% in 2024 and increase +24% in 2025.

Valuations : all over the place. Europe + Japan are cheap. US stocks expensive.

Now for the scary part #1

Inventory digestion will delay revenue recovery. The chart below is the internal inventory at the Semi Vendors (ie STM, TXN); this is what Semi Vendors will sell into the end-demand recovery.

Sum of inventory in US$ m: Analog Devices, Infineon, Microchip, NXP, On Semi, Renesas, ST Micro, Texas Instrument.

But first, inventory must be cleared at distributors, Tier-1 system makers, end-customers. We do not know how much there is and most Semi Vendors mention that their clients are in the process of reducing their inventory. Most Semi Vendors mentions that, as a result, their manufacturing utilization will remain low in 2H24 (otherwise Semi Vendors will just increase their internal inventory). The recovery for out-sourced demand (ie to Foundries) will take even longer.

Scary part #2

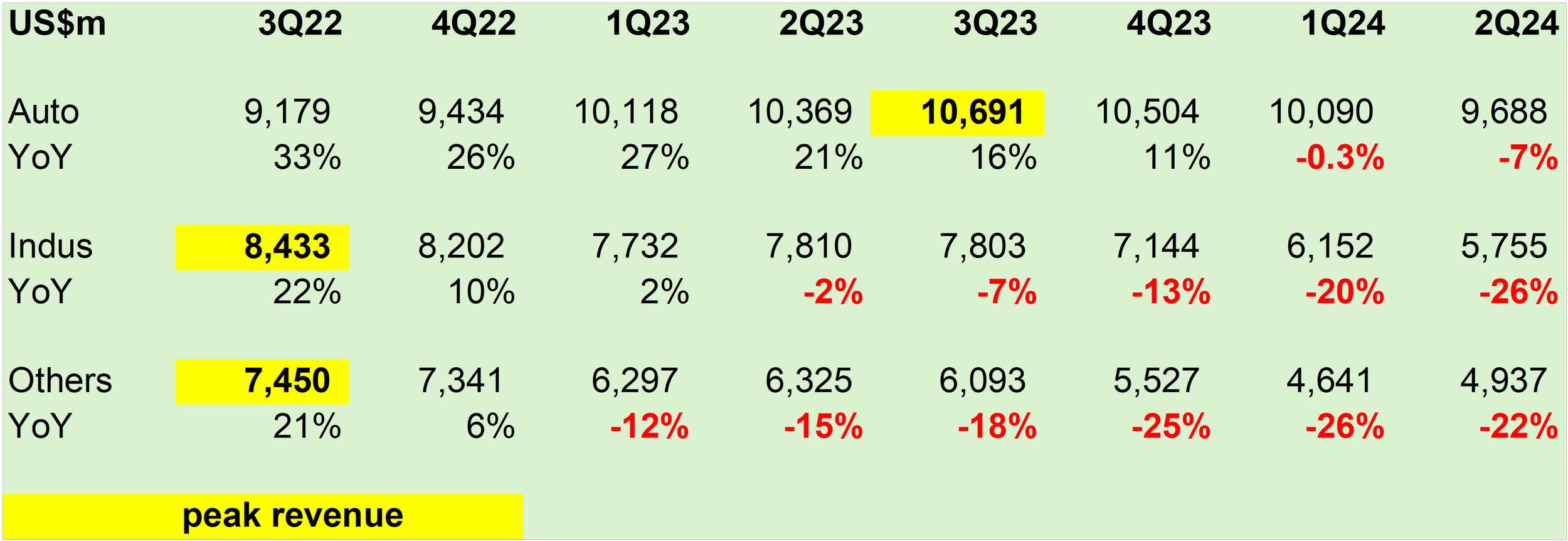

Sum of reported segments: ADI, IFX, NXPI, ON, Renesas, STM, TXN in US$ m. Microchip is not included as the firm doesn't report segment revenue.

Auto = 48% of revenues in 1H24 and is just starting to decline YoY in 2Q (EV demand weaker, high inventory).

Industrials = 28% of revenues, declining by -23% YoY in 1H24 and not recovering yet (EU, Japan, US remain weak. China better).

Others (telecom, data center, consumer) = declining by -24% YoY in 4Q23-2Q24, stabilizing at a low level, seasonal demand kicks in from 2Q for consumer electronics. Telecom and Data center enterprise budgets are

A compounding problem?

The weird thing is that if you listen to Hua Hong, UMC or Vanguard, Auto orders were cut down from 4Q23, got worse in 1Q24 but the Semi Vendors’ managements (ie Infineon, NXP, STMicro) say that Auto demand is just getting weaker from 2Q24.

I think this is a double-problem:

Stage 1 4Q23-1Q24: inventories were too high and firms cut down orders (i.e. STM cutting at UMC) to lower their inventories.

Stage 2 from 2Q24: Auto end-demand is weaker than expected, hence a new message from Semi Vendors (weak Auto demand just starting) and further cuts at Foundries.

Reading back the 4Q23 transcripts, we have compounding weakness in Auto: first inventory digestion, then weaker end-demand.

Where is the bottom?

TXN management had, maybe, the best summary of the situation – I’m paraphrasing below:

A weak end-demand / high inventory cycle usually takes 6-8 quarters.

Industrials has been correcting for 5 quarters (5 quarters of negative YoY).

Auto has just started its correction.

Sum of reported segments: ADI, IFX, NXPI, ON, Renesas, STM, TXN in US$ m. Microchip is not included as the firm doesn't report segment revenue.

from Factset I/B/E/S

As mentioned above, Consensus has barely revised down post 2Q results and the shape of YoY revenue and net income is like this:

Which looks… optimistic? Revenues are recovering from 3Q24 (ie declining less YoY) and indeed 3Q24 guidance says that. But the risk is that the language and tone of the Semi Vendors is actually correct: Auto is correcting while Industrials isn’t improving.

Valuations: wide disparity

Valuations as off 5 Aug 2024, IBES Consensus data.