Smartphone growth is slowing down in 3Q24. Mediatek. Qualcomm

Smartphone growth is slowing down to +4% YoY in 3Q24. MTK and QCOM see increasing ASP with AI

Smartphone Growth Is Slowing Down to +4% YoY in 3Q24. Mediatek had a good rally, time to take a break

Smartphone growth is slowing down but ASP are increasing for Mediatek with 5G AI-enabled phones. Mediatek has other drivers, AI chips and Auto GPU. The stock is up 33% YTD and is expensive.

How Big Is the AI Accelerator Market? AMD, Broadcom, Nvidia, SK Hynix, TSMC

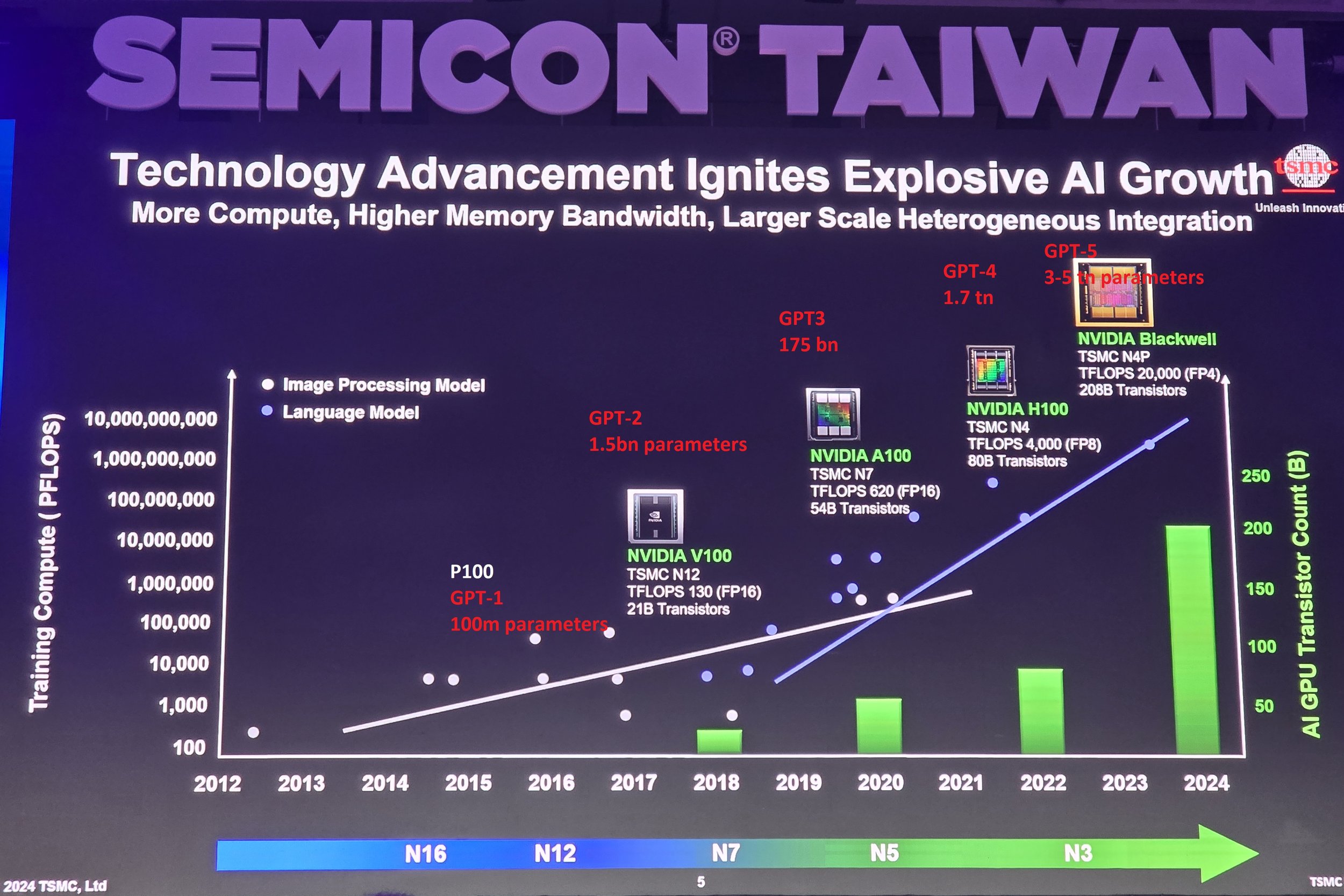

AMD estimates AI Accelerators will reach US$500bn by 2028 ($45bn in 2023). Accelerators increased by 150% in 2024, reaching US$113bn. Based on TSMC CoWoS, we expect 115% growth over 2025-26, $276bn in 2026.

TSMC makes all the chips. HBM is dominated by Hynix, Micron in 2nd place. Nvidia should remain the dominant vendor for years. AMD and Broadcom should grow faster than NVDA. Outsourcing: Alchip, Marvel, Mediatek.

3Q24 PC Shipments Are Flat YoY. Lenovo, Acer, Asus. Compal, Quanta, Wistron

IDC reported 3Q24 PC shipments declining -2% YoY, Canalys an increase of +1%. Let’s call this flat. If 4Q24 is “average seasonal”, 2024 will reach ~265m, or the pre-Covid range.

No AI fever, no accelerated replacement cycle, for now. If it happens, it will take time, ie compelling AI apps that only run locally and need a new PC.

In Asia, PC vendors: Lenovo, Acer, Asus. Taiwan ODM: Compal, Quanta, Wistron. Semi with high exposure: Novatek, Realtek.

TSMC, UMC Monthly Sales: TSMC up Strong but Plateauing, UMC Lackluster, Confirming 2 Big Trends

AI demand will remain strong but is plateauing in terms of YoY growth. The rest of end-demand remains weak (Consumer, PC, Auto, Industrials). TSMC and UMC monthly sales confirm this.

TSMC high growth plateau ~40% YoY: AI (Nvidia Broadcom, AMD), Intel, new smartphone chips. Comps will get harder early 2025. Valuations are high but not extreme: limited upside and downside.

UMC lackluster at ~6% YoY growth, reflecting lackluster end-markets from smartphone, Consumer Elec, PC, Auto & Industrials. Average valuations; in need of an elusive catalyst.

All Is Not Well in Tech Sector, AI Growth Slows, TSMC Expensive. Samsung, SK Hynix More Attractive

The rally of the Asia Tech sector (+24% YTD) is highly concentrated in a handful of stocks. TSMC is up 64% but Samsung is down -22% YTD.

With the exception of AI, end-demand isn’t great.

End-demand in the Consumer and Enterprise segments is flattish; related stocks have underperformed. We see little reason to expect significant growth in 2025.

Important turnarounds in 2025 will be Industrial electronics back to growth in 1H25, Auto electronics bottoming out mid-25.

Smartphone up 8% but below 2019-21 level. PC flattish. x86 Server flattish. Telecom capex declining. Automotive electronics declining.

AI is the most disruptive trend since Cloud in 2010. Years of increasing Capex are in front of us. But short-term, stocks are properly valued to rich, growth is slowing.

AI is the only growth driver but growth is slowing; related stocks have outperformed but are often expensive. We expect AI related Capex to increase in years ahead, but stocks probably need a consolidation period.

Korean Memory looks attractive, both on valuations and low expectations, despite short-term concerns such as high inventory for PC DRAM.

SEMICON Taiwan 2024: no roadblocks down to A10 in 2029

The Semi industry has qualified its roadmap down to A10 in 2029. The Technologies work in the Lab and can be industrialized. This is the Nanosheet or GAA generation.

From 3nm (2024) to A14 (2027), wafer and packaging costs will probably double. This implies that the addressable market will only be High Perf Computing / AI. Smartphones, iPhone included, don’t need the performance and can’t justify the cost.

The roadmap of the Semi industry to 2029 is geared to AI Compute. The Semi industry from chemicals, equipment makers to foundry and chip designers are clear about this: future revenue growth will come overwhelmingly from the AI segment. The Semi industry is not trying to pack more transistors in the same form-factor. It is aiming to make chips as systems, as large as possible. The new KPI is more FLOPS per Watt. Cost is a more distant concern.

The following generation post-2029 will adopt a different transistor structure, CFET which will require new lithography and new materials.

TSMC and UMC monthly sales confirm peaking Semiconductor growth

I wrote here on Semi revenue growth peaking. TSMC and UMC monthly revenues confirm this

TSMC is on a high peak of year-on-year growth that isn’t moving higher, reflecting High Perf Computing, AI-Accelerators, AI-smartphone peaking out for now

UMC is back to flat year-on-year, reflecting the mild end-demand stabilization and inventory re-built in Consumer Elec, mass-market Smartphone, PC, while Auto & Industrials are declining

Semi revenue growth has peaked. Stocks as well.

2/3rd of Semiconductor revenues are slowing down into 2H24 (AI, PC, Server, Smartphone)

The recovering segments (Industrial, Networking, Auto) are too small to change the overall trajectory

The Semi sector is still expensive – valuations charts are borderline scary

3 divergent trends in the Foundry market. Legacy Foundry see a slow recovery. Chinese buyers are stockpiling. TSMC on its own cloud.

Legacy demand is recovering slowly for ex-China Foundries (Global Foundries, UMC, Vanguard). 1Q24 marked the bottom of the revenue cycle. Excess inventories are almost digested. 2H24 revenues will increase HoH but slowly, end-demand is lackluster. The positive is that margins have held up very well despite low utilization at ~70%. UMC stock is cheap, still.

China Legacy (Hua Hong, SMIC) is booming, firms say that demand is great... really? Or Chinese Semi customers are worried about further embargos? It’s coming (BBRG: ASML’s China Business Faces New Curbs). Both Hua Hong and SMIC stocks are expensive. The positive is that… ? inventories in China are increasing.

TSMC is driven by EUV demand: AI boom NVDA and Broadcom, AMD share gains, Intel outsourcing, Smartphone chips upgrade. EUV nodes are now 66% of revenues. On its own cloud.

NVDA post-market reaction (-7%) highlights the valuation problem. The correction of the tech sector should resume

NVDA 2Q beat consensus, 3Q guidance beat consensus, the stock declined post-market.

Overall, growth in Tech is mediocre (PC, smartphone, enterprise, telcos), with growth concentrated in AI Semis and Hyperscalers

The Tech segment of the NASDAQ 100 is expensive, Non-Tech is not.

Auto / Industrial Semiconductors: the bad & the ugly #2

The late reporters Infineon, Microchip, ON Semi, confirm what the early reporters said. Auto getting weaker. Industrials in EU, Japan, US remains weak. Clients’ inventory digestion still ongoing.

Tech valuations: still not low. Reasons for a large correction are usually quite simple - as it is now

Despite a ~20% correction, valuations are still high, based on 2025 expectations that are high. That’s the core of the on-going correction. 2Q earnings were bad? Not really. Nasdaq and SOX Consensus (IBES) net income forecasts for 2024-25-26 are barely changed. So it’s the job report and the macro, isn’t it? I’ll keep my unqualified macro views to myself and more practically: 1) valuations remain high to very high 2) 2025 Consensus expectations are high, room for upside? Not clear for Semis

Auto & Industrial Semiconductors: the bad & the ugly (NXPI, Renesas, STM, TXN). Mostly negative comments from firms, imo.

Results of Automotive & Industrial semiconductor firms (Analog Devices, Renesas, ST Micro, Texas Instruments) all point to 2 problems. Auto demand is weakening, unexpectedly, as EV demand is below plans and inventories high. Industrial demand is not recovering in EU, Japan, US.

TSMC 2Q24 is good, 3Q guidance even better with margins improvement.

TSMC delivered a good 2Q24, 3Q guidance is even better with margins going up. Revenue growth of High Perf Computing incl. AI and EUV nodes is extremely impressive: above +60% YoY

SEMI valuations: stretched. Room for consensus to move higher? Not easy.

SEMI valuations: stretched. Room for consensus to move higher? Not easy.