TSMC 2Q24 is good, 3Q guidance even better with margins improvement.

TSMC revenue NT$ bn, YoY. Margins. 3Q24 guidance included.

2Q24 results are good

close to guidance, revenue up 40% YoY

good because of the mix, with a strong increase in HPC / AI. HPC revenue up 57% YoY

even though underlying shipments & utilization remain slow

3Q24 guidance: margins improving

Revenue guidance NT$741bn, just 1 % above consensus 732bn.

Revenue growth guided at 36% YoY, just a tad below 2Q 40% (TSMC often beats guidance) so we are on a high growth plateau at ~40% YoY. Assume this is driven almost entirely by HPC (AI). Small improvement in PC and Smartphone likely. Decline in Auto, Server likely.

Margins improving 100bps compared to 2Q (guidance usually conservative). Consensus is expecting flat margins in 2024 and margins recovery in 2025. Margins upside isn’t in consensus for 2024. I wrote yesterday here that if consensus is revised up, it will be on higher margins rather than higher revenues. 3Q24 guidance seems to confirm this. See 2024 outlook below.

Why are margins moving up? Higher utilization and higher EUV / HPC mix.

2024 outlook

TSMC guides revenue growth slightly above mid-20% in US$. Consensus is forecasting 28% YoY in NT$ which should be close to ~23-24% in US$. So TSMC new 2024 revenue guidance suggests consensus is ~2-3% too low.

2024 Capex budget: narrowing to US$30-32bn (previously 28-32bn)

70-80% for advanced process

10-20% specialty

10% packaging, testing, mask

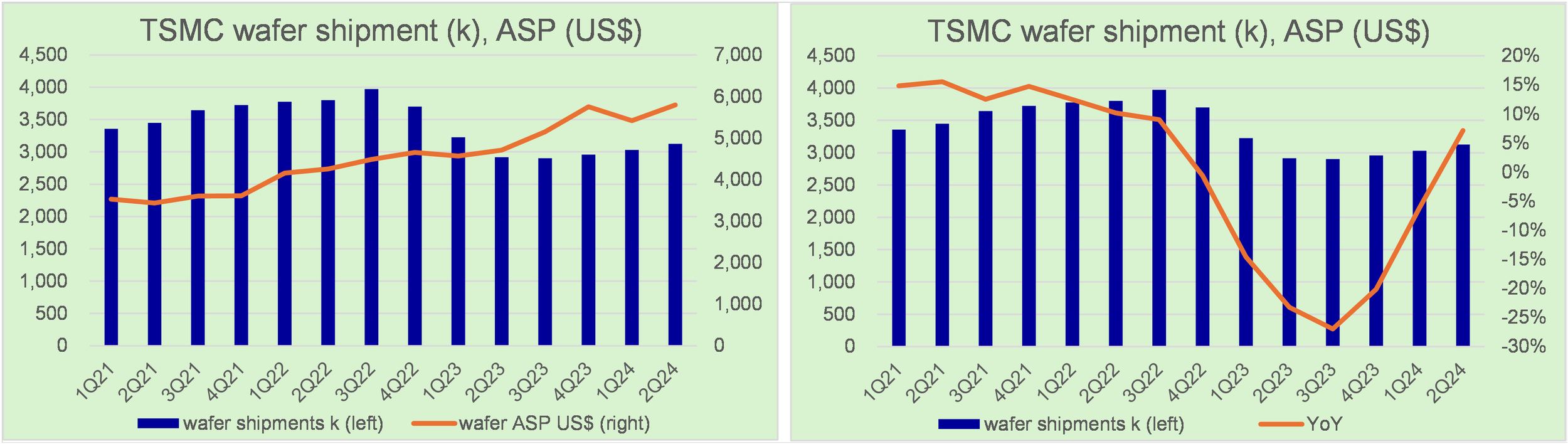

TSMC wafer shipments (k / quarter), ASP in US$, wafer shipments YoY

Back to 2Q24 (charts above)

Revenue up strongly, even though shipments are increasing very slowly. The mix is the main reason for revenue growth (more HPC incl NVDA, hence higher wafer price).

Revenue NT$674bn up 40% YoY, broken down:

Wafer shipment 3.1m up 7% YoY

Wafer ASP US$ 5.8k up 24% YoY

FX up 5% YoY

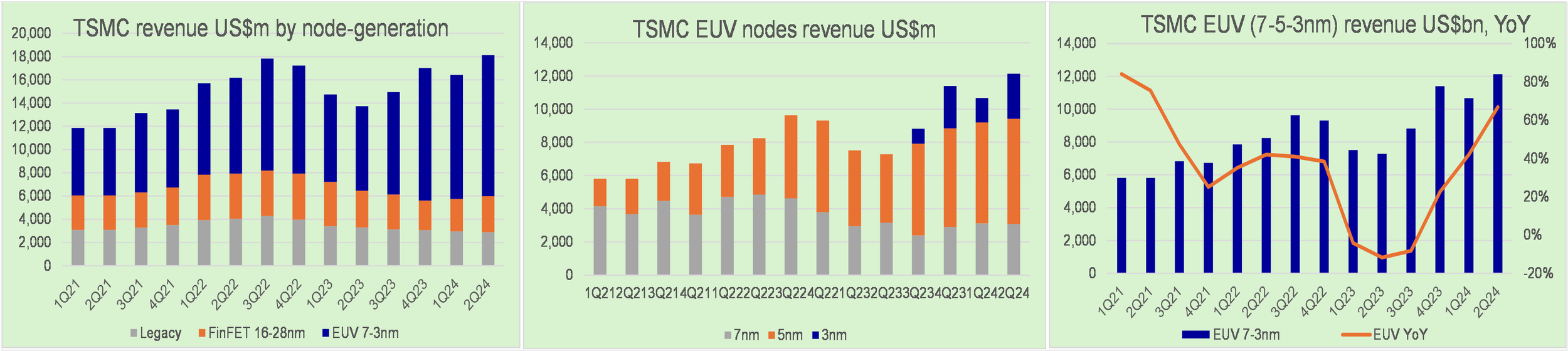

The increase in EUV and HPC revenues is just very impressive: +69% YoY for EUV and +57% for HPC. At the opposite, Auto, Consumer and Legacy nodes remain depressed.

TSMC revenue breakdown by node / platforms US$ m

Capex US$bn 1Q24 ~6bn, 2Q ~6 = 1H24 US$ 12bn

TSMC revenue by nodes US$ m

TSMC revenue by platforms US$ m

Management comments (and mine)

Margins

2Q24 margins a bit better: better utilization

3Q24 margins: higher utilization, cost improvement, strong Smartphone and AI related demand

but pressure from N3 ramp, N5 to N3 tool conversion, electricity cost up.

Mngt is not excluding converting more N5 into N3 as N3 demand is strong. Implying costs short-term but better margins long-term.

Phase 1 Arizona and Kumamoto will dilute gross margins by 2-3 pct points for several years but mngt maintains that “53% and above is achievable”. High-50s Low-60% gross margins is possible on very high utilization.

Subsidies

When subsidy is received, it offsets the asset value on balance sheet. 2023 US$1.5bn received, mainly in Japan.

At production, it depends on each country’s rules.

Market outlook for 2024

Semi market excluding Memory up 10% YoY

Foundry 2.0 industry up 10% YoY. TSMC share was 28% in 2023, will increase in 2024.

TSMC has changed its definition of “foundry” to now include incl packaging, testing, masks, all IDM capacity (i.e. including Intel). Market value of US$ 250bn in 2023 (115bn under old definition, strictly Foundry)

2024 revenue growth slightly above mid-20% in US$. Consensus is forecasting 28% YoY in NT$ which should be close to ~23% in US$. So TSMC new 2024 revenue guidance suggests consensus is ~2-3% too low.

Technology

N2 production scheduled for 2H25. N2P production scheduled for 2H26

A16 includes nanosheet and SPR Super Power Rail (back side power delivery) to preserve gate density on front side. Production scheduled for 2H26.

CoWoS capacity

Demand is so high that there is tightness or “great shortage”. Balance in 2025 or 2026. TSMC is increasing ”whatever we can” “all the way to 2025”.

Mngt previous comment was CoWOS capacity will double in 2024.

TSMC is working with back-end OSAT partners to increase capacity.

AI demand

AI implementation in devices leads to die size increasing by 10%.

TSMC is not seeing unit growth yet for edge devices (smartphone, PC), maybe 2 years later.