SEMI valuations: stretched. Room for consensus to move higher? Not easy.

Asia ex-Japan Technology sector valuations: average on 2025E

The Semi craze continues, for a lot of good reasons – but valuations still matter.

Asia ex Japan TECH is ok

AxJ Tech is trading at + 1 standard deviation on 2024 earnings but on average PEx on 2025. Expensive short-term, properly priced on next year earnings.

This assumes that consensus is correct about very high earnings growth: +67% in 2024 and +36% in 2025 (that’s YoY, sum of US$ net income of top 80 Tech firms Asia-ex). What’s driving this high growth is 1) Korea Memory contributes 3/4th of the growth 2) Taiwan Semi most of the rest.

Consensus also expects 15% earnings growth in 2026, implying that the structural factors continue (AI, HBM) and cyclicality is positive (I guess we all expect lower inflation and rates).

Net Income forecasts for Asia ex-Japan technology sector: high growth for 3 years (I/B/E/S consensus)

Trailing valuations:

Avg PEx since 2019: 18.8x

Now : 24.8x

Forward valuations:

Avg PEx since 2019: 17.0x

Now : 17.0x

Asia ex-Japan Technology sector valuations: average on 2025E

Stretched valuations are obvious for Semis, looking at the SOX.

My SOX proxy is trading at +2 standard deviations or more, both trailing and forward.

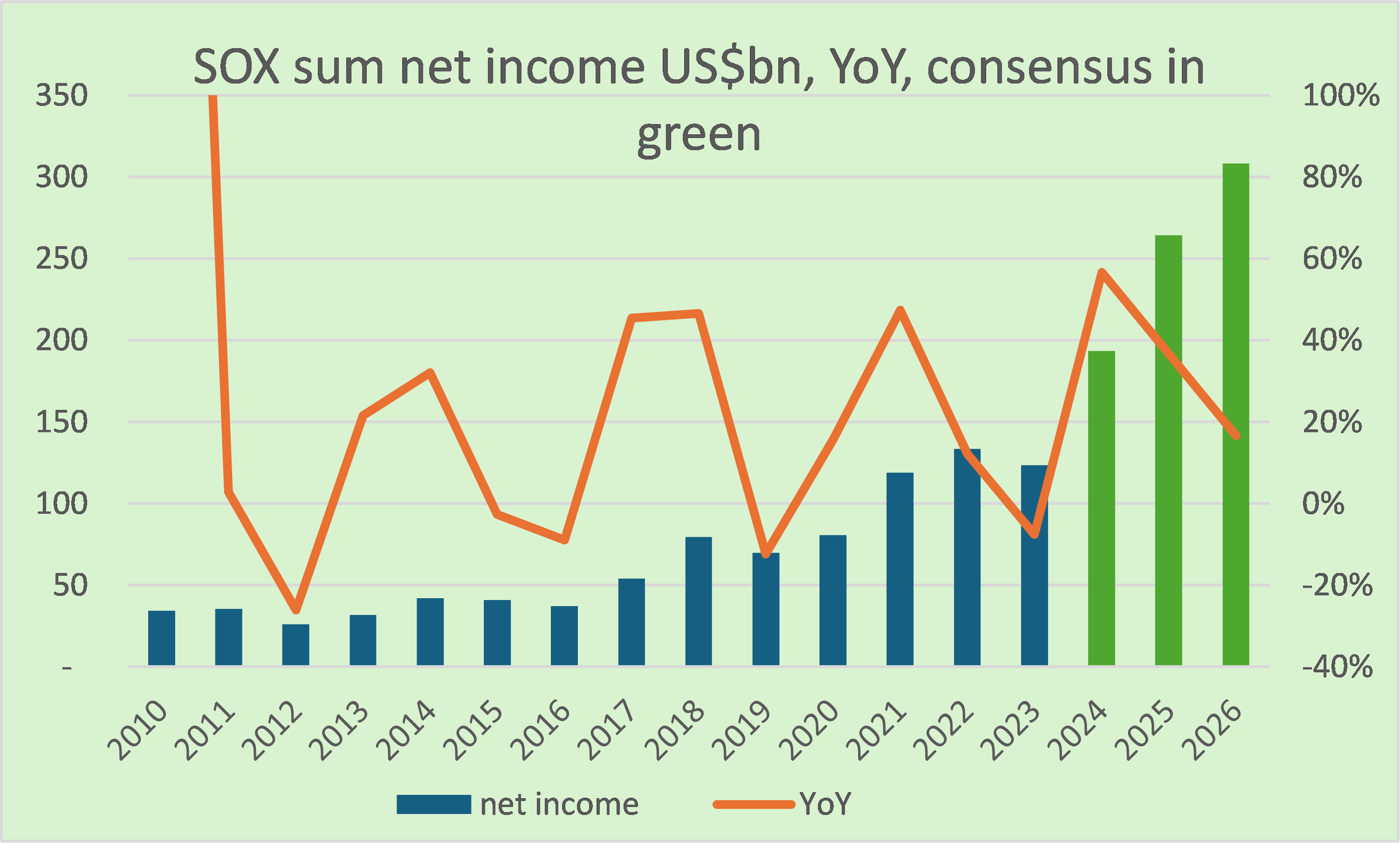

Consensus expects net income growth at 57% in 2024, 37% in 2025 and 17% in 2026. This reflects 1) AI-related AVGO, NVDA, TSM but also 2) Memory and 3) Mobile recovery as inventories are cleared and there’s a bit of end-demand growth YoY 4) some recovery in Equipment and Analog / MCU in 2025 (declining in 2024).

So consensus is feeling pretty good about structural new stuff and cyclical recovery at the same time. Yes, probably, but valuations are really up there.

SOX Net Income forecasts: high growth for 3 years (I/B/E/S consensus)

Trailing valuations:

Avg PEx since 2019: 25.8x

Now : 45x

Forward valuations:

Avg PEx since 2019: 21.4x

Now : 31.7x

I do not like inflammatory statements, but we are at historical high valuations. 2024-25 earnings growth is spectacular but not higher than 2017-18 (45% each year) or 2021 (47%). My guess is that on top of the sentiment-value of Semi (AI will change the world, massive government subsidies, etc etc in the news everyday), there is also portfolio concentration in Tech as long as rates are high and small caps (low profits, high debt) are avoided. YTD Nasdaq has outperformed Russell 2000 by ~15pct points.

The main risk to SEMIs is probably the reversal of this trade, i.e. the reality of rates cuts leading fund managers to reduce outperforming Tech and increase underperforming Small Caps. Maybe this has already started with IWM (iShares Russell 2000 ETF) going up 12% in July and outperforming VOO (Vanguard S&P 500 ETF) by ~10pct pts.

SOX valuations: stretched!